Bearish scenario: Sell below 2200 / 2194 ... Nearest bullish scenario: Buy above 2197... Bullish scenario after retracement: Consider buys around each indicated demand zone

2024-01-16 • Updated

The price of Gold (XAU/USD) has experienced a significant sell-off, dropping to around $2,040 after failing to surpass the weekly high of $2,062. This decline occurred as investors reassess the potential timing of interest rate cuts by the Federal Reserve (Fed). The sell-off followed the release of the Consumer Price Index (CPI) report for December, which showed resilience, and hawkish comments from European Central Bank (ECB) officials.

Investors are now reevaluating the possibility of a rate cut in March, with the Fed appearing in no rush to adopt a dovish stance on interest rates. Despite inflation in the U.S. being nearly double the 2% target, labor demand remains stable, and the risk of a recession is deemed low. The current interest rates ranging between 5.25-5.50% allow the Fed to maintain a relatively restrictive monetary policy stance for the time being. The gold price is expected to remain uncertain until there are clearer signals regarding the Fed's stance on interest rates. If it fails to hold above the January 3 low of $2,030, it could face further downside pressure, potentially reaching the psychological support level of $2,000.

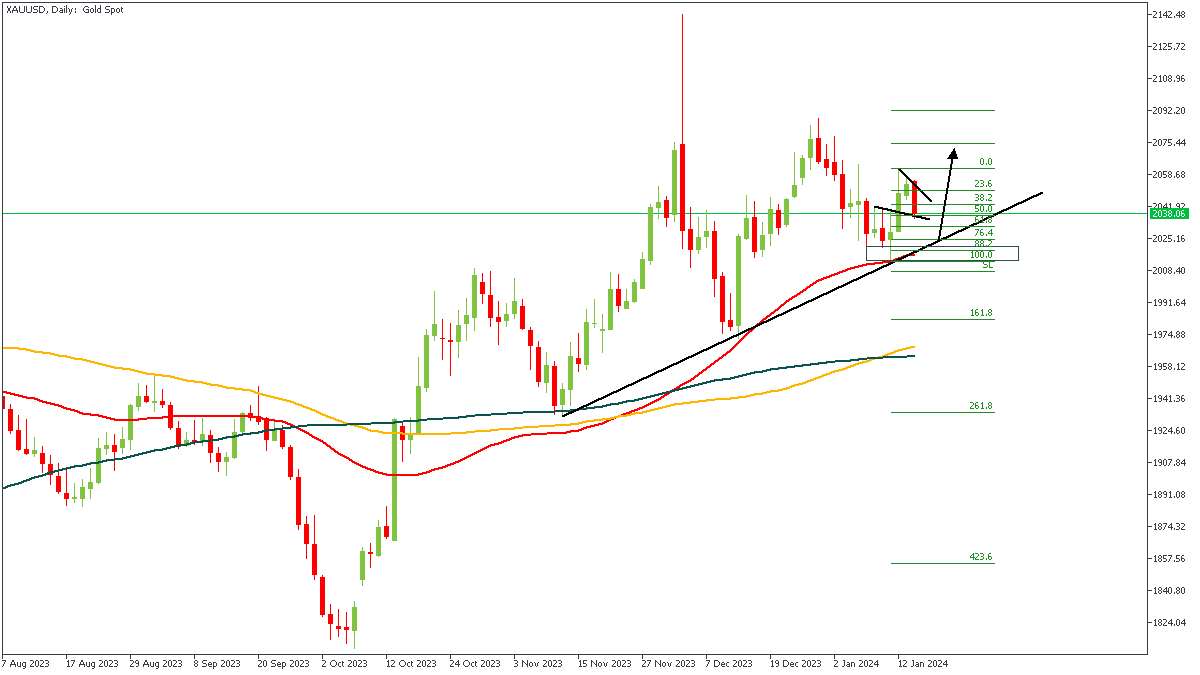

On the Daily Timeframe of XAUUSD, we see the bullish array of the moving averages indicating the likelihood of a bullish continuation. The presence of a trendline support adds further confirmation to the bullish sentiment, as well as the 76% of the Fibonacci retracement.

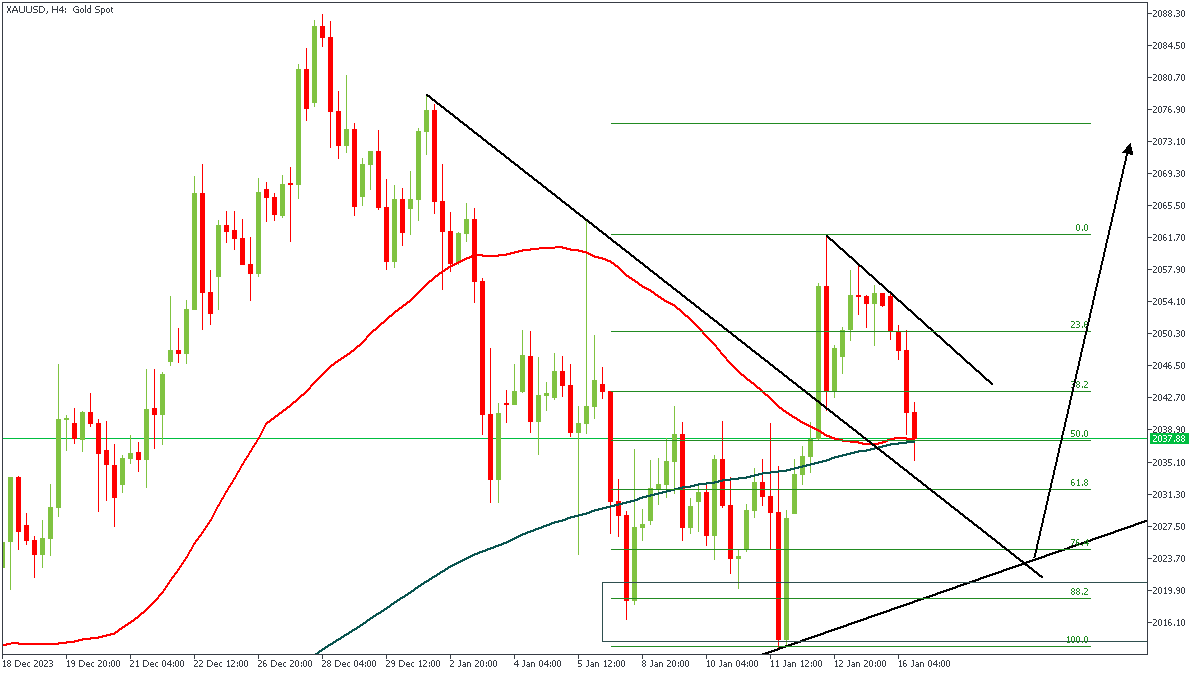

On the 4-hour timeframe of XAUUSD, we can see the intersection of support trendlines, as well as a convergence of moving averages. Based on my strategy, I can also see the presence of an inverted head-and-shoulder pattern. In summary, all factors point in favour of the bullish sentiment.

Analyst’s Expectations:

Direction: Bullish

Target: $2050

Invalidation: $2012.67

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

Bearish scenario: Sell below 2200 / 2194 ... Nearest bullish scenario: Buy above 2197... Bullish scenario after retracement: Consider buys around each indicated demand zone

Bullish scenario: Intraday buys above 2160.00 with TP: 2171 and TP2: 2177 // Bearish scenario: Sells below 2177 with TP1: 2150, TP2: 2142, and 2126

This article uses price action and volume profile techniques to address a fundamental and technical perspective based on the daily chart analysis of spot gold (XAUUSD).

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!