The energy industry has undergone several major changes in the XXI that are becoming increasingly apparent…

2021-04-21 • Updated

The earnings season is hitting up! Follow Intel and AT&T on April 22, big moves are awaited!

Intel has kept its number 1 place in the semiconductor industry even amid the ongoing global chip shortage. However, the competition is hot and NVIDIA is stepping on the toes. Last week, NVIDIA announced the launch of a new data-center processor which can replace Intel's one. It’s believed that NVIDIA is on the way to dominate the chip sector. Thus, Intel is at risk to lose its value.

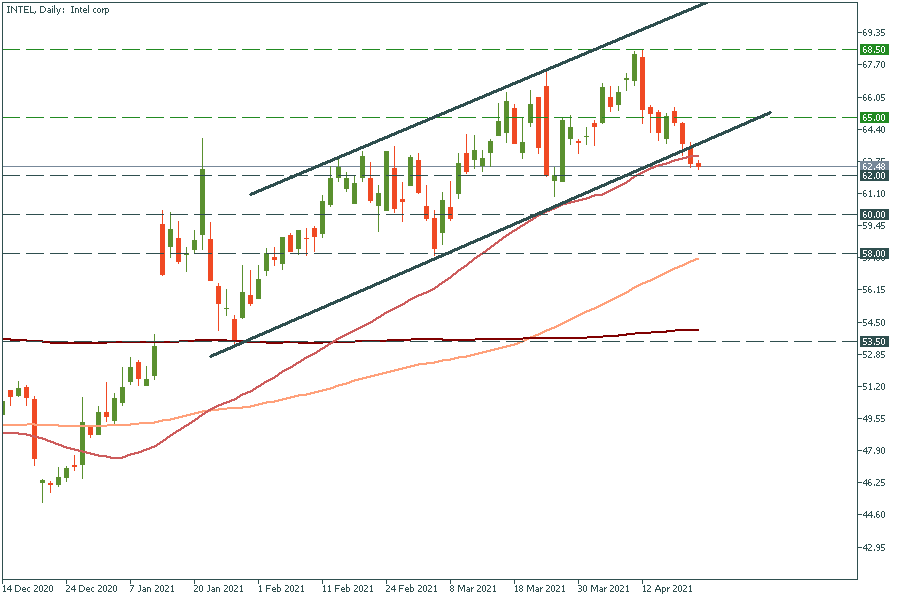

Let’s look at the stock from a technical perspective. It has been moving inside the ascending channel since the beginning of this year. However, yesterday it dropped out of it. If it breaks the recent low of $62.00, the way down to the key psychological mark of $60.00 will be open. On the flip side, if earnings are great, it may push the price back inside the channel and then to the high of April 15 at $65.00.

5G, Fiber, and HBO Max – are the three things that most impact AT&T these days. The company is expected to deliver strong year-over-year earnings due to the success of the HBO Max streaming platform. AT&T expects to attract 67 million to 70 million HBO Max subscribers by the end of 2021. Moreover, HBO Max has a higher-than-average price of $15 a month. As a result, it brings more revenue for the company, unlike its rivals.

Time to look at the chart! The stock has been moving inside the ascending channel since early February. Since it’s in a lower part of the channel, it has a higher potential to rise. If it breaks the psychological level of $30.00, the way up to the April high of $31.00 will be open. Support levels are the low of April 13 at $29.50 and the psychological mark of $29.00.

Intel is expected to deliver $1.14 earnings per share and revenue of $17.78 billion on midnight from April 22 to April 23 by MetaTrader time (GMT+3).

AT&T is expected to deliver $0.7769 earnings per share and a revenue of $42.7 billion at 15:30 on April 22 MT time (GMT+3).

Don't know how to trade stocks? Here are some simple steps.

The energy industry has undergone several major changes in the XXI that are becoming increasingly apparent…

The past two years have seen the biggest swings in oil prices in 14 years, which have baffled markets, investors, and traders due to geopolitical tensions and the shift towards clean energy.

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!